TRANSFORM LIVES

WITH AZ CHARITABLE TAX CREDIT

You decide how your state tax dollars are spent!

Make Tax Credit Donation

Lives are being rebuilt and transformed!

NEED HELP?

Do You or Someone You Know Need Help Today?

Get Your Tax Credit:

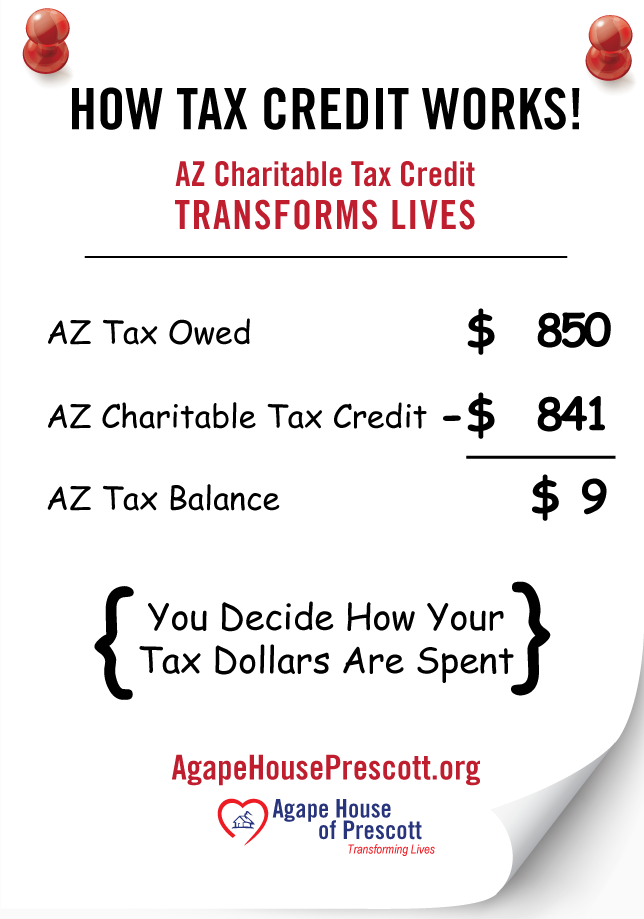

$841 for a married couple

$421 for single filers

What You Need To Know About AZ Charitable Tax Credit

- A tax credit is a dollar-for-dollar reduction of the income tax you owe. For example, if you owe $1,000 in Arizona taxes, but are eligible for an $841 tax credit, your net liability drops to $159.

- Tax Deductions only reduce the amount of your income that is subject to tax, whereas credits directly reduce your tax bill.

-

For additional information, please consult your tax advisor or visit AZDOR.gov website, to learn more about Form 321 which is required by the AZ Dept. of Revenue to report the contribution. For a sample copy of Form 321 please click here.

Arizona taxpayers can donate up to $841 for a married couple and $421 for single filers and receive a dollar for dollar credit. Please consult your tax adviser for further information. Arizona Charitable Tax Credit keeps your tax dollars in the Prescott area supporting homeless families when you donate to the Agape House!

Your Money. Your Choice.

WHY AGAPE HOUSE

Agape House of Prescott shows families in crisis love and support and share the hope of Jesus. Through discipleship, mentoring, life skills training, and interim housing for homeless families in crisis, Agape House has achieved an 86% success rate of families living independently one year after leaving the program.

Agape House is working diligently to make a significant impact on the homeless crisis in Prescott.

ADDITIONAL AZ CHARITABLE TAX CREDIT INFORMATION

Agape House’s official Qualifying Charitable Tax Credit code from the State of Arizona is: 20162. Please keep this code for use on your tax documents. Agape House of Prescott is a Qualified Charitable Organization and contribution may be eligible for a dollar-for-dollar AZ CHARITABLE TAX CREDIT. Please consult your tax adviser for further information.